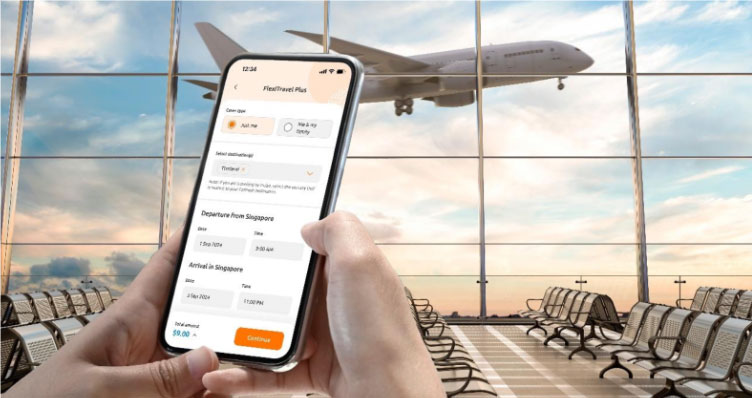

SINGAPORE, 11 September 2024: Income Insurance launched FlexiTravel Plus on Tuesday, Singapore’s first travel insurance that enables travellers to extend travel protection, as needed by the hour, to 19 Asian destinations*.

FlexiTravel Plus is part of Income Insurance’s latest suite of travel insurance innovations, which also include an industry-first post-departure purchase feature and a new overseas telemedicine service.

As the plus-sized travel insurance for short trips, FlexiTravel Plus replaces FlexiTravel Hourly Insurance, which only covers travellers to Bintan, Batam, and Malaysia. It is part of Income Insurance’s latest travel insurance innovations, which provide greater flexibility and value-added benefits for travellers.

FlexiTravel Plus charges a minimum of SGD1.80 for a six-hour block of protection. Travellers can extend coverage at SGD0.30 for every additional hour, capped at a maximum charge of SGD3.00 per day. For instance, a 3D2N trip to Thailand would only cost a maximum of SGD9.

The launch of FlexiTravel Plus is part of Income Insurance’s ongoing commitment to closing protection gaps in Singapore by offering customer-centric options when customers go on short getaways to destinations in Asia.

FlexiTravel Plus covers:

Trip disruptions, travel delays and alterations;

Overbooked public transport;

Insolvency of agency;

Loss of handphones and electronic devices due to robbery and snatch theft;

Overseas medical expenses and emergency medical evacuation;

Sports equipment such as golf clubs and surfboards (via opting for a rider).

In addition, Income Insurance’s Enhanced PreX Annual Travel Insurance, the only annual travel plan offered in Singapore that covers pre-existing medical conditions, now includes a new benefit: overseas telemedicine service for policyholders. Policyholders can access a doctor from Income Insurance’s appointed medical provider 24/7 via an overseas emergency hotline.

Income Insurance Vice President & Head, Key Accounts Management, Annie Chua commented: “Given their busy lifestyle, travellers may sometimes forget to purchase travel insurance. At the same time, some may not regard conventional travel protection as necessary, especially when going for a short getaway. We aim to bridge these gaps by offering travel insurance options tailored for modern travel patterns and prevalent concerns so that travellers mindfully close their protection gaps and enjoy peace of mind.”

“We are encouraged that more travellers see the importance of protecting themselves while they go on short trips, even a weekend getaway, as the take-up for FlexiTravel Hourly Insurance in 2024 tripled last year’s. This has motivated us to launch FlexiTravel Plus, the plus-sized version to protect short trips to 19 Asian destinations so that travellers have affordable and flexible travel protection options,” Chua added.

About Income Insurance

Established in 1970 to address a social need for insurance, Income Insurance Limited is one of the leading composite insurers in Singapore, offering life, health, and general insurance.

* Brunei, Cambodia, Indonesia (including Batam and Bintan), Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam, Australia, China, Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, and Taiwan.

The post Travel insurance booked by the hour appeared first on TTR Weekly.